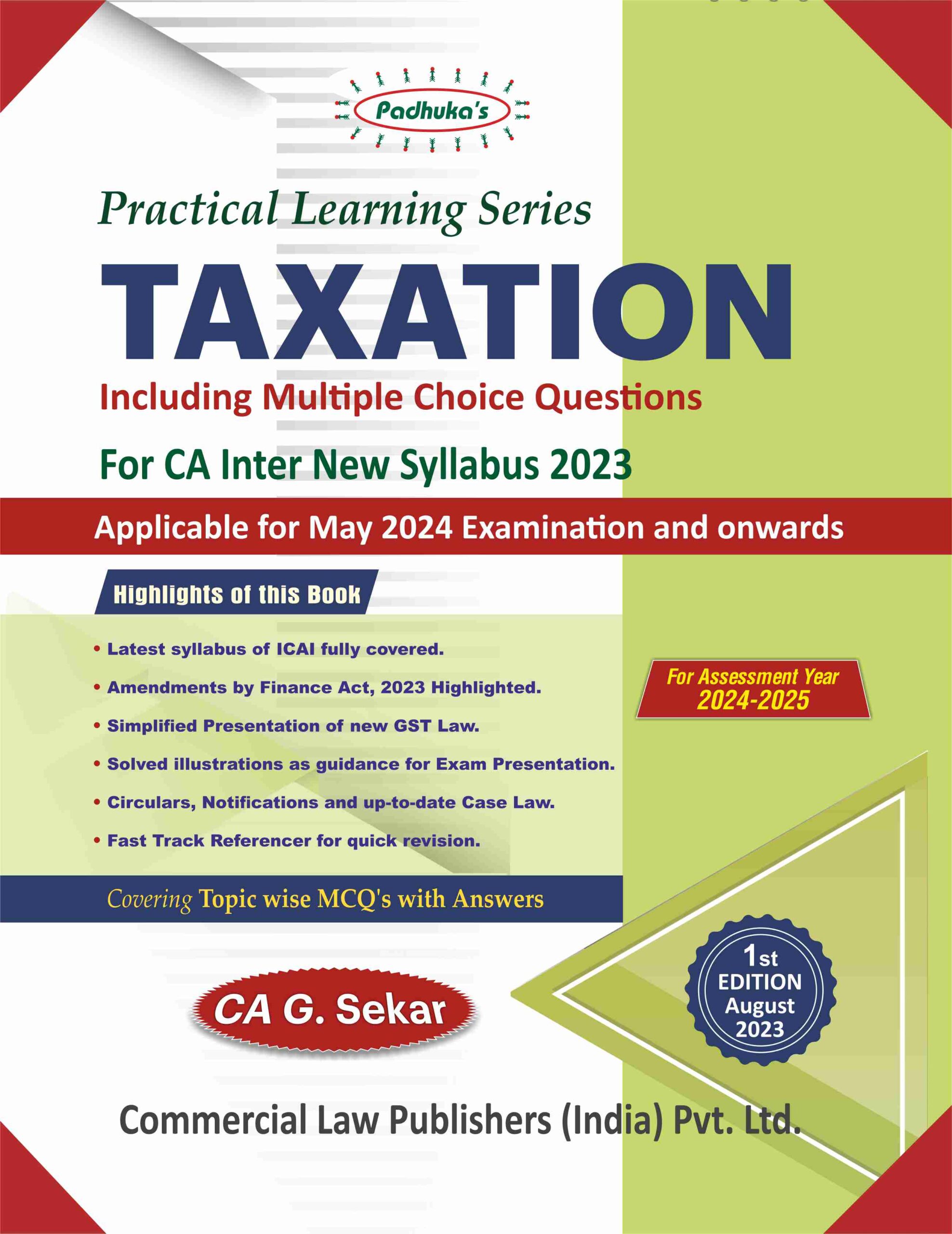

Practical Learning Series Taxation for CA Inter New Syllabus 2023

The latest Syllabus of ICAI is fully covered.

– Amendments by Finance Act, 2023 Highlighted.

– Simplified Presentation of new GST Law.

– Solved Illustrations as guidance for exam Presentation.

– Circulars, Notifications, and up-to-date case law.

– Fast Track Referencer for quick revision.

- Sekar

- Sekar has been a Chartered Accountant in practice for the last 37 years.

Board Member of Airports Authority of India (AAI) – 2019-22

Chairman – Direct Taxes Committee of ICAI – 2014

Chairman – Ind AS Implementation Committee 2021

Member of Consultative Advisory Group (CAG) (2017–2019) of the prestigious International Accounting Education Standards Board (IAESB) It is worthy to note that he is the first Indian to be part of the CAG Great Motivator for Chartered Accountants in Practice and in Employment, and CA Students, through his effective and convincing communication style.

– Member of the Expert Study Group Committee, Central Board of Direct Taxes, New Delhi, to study the Direct Tax Code Bill in 2006.

– Recipient of a Special Award from the Income Tax Department in 2011, during their “150 Years of Income Tax in India” Celebrations, for his contribution and service to the Income Tax Department.

– Author of Professional Books for Finance and Legal Professional Corporate, Taxpayers, Bank Official of Income Tax Department, etc.

Commerce Graduate, Gold Medallist & Rank Holder from Madurai Kamaraj University.

– Author of Professional Books for Finance and Legal Professional Corporate, Taxpayers, Bank Official of Income Tax Department, etc.

Reviews

There are no reviews yet.